Understanding Candlestick Evaluation

Candlestick evaluation is a necessary approach on this planet of buying and selling that gives invaluable insights into market sentiment and potential value actions. Every candlestick represents a particular time interval, displaying the opening, closing, excessive, and low costs inside that timeframe. This visible illustration of value motion permits merchants to evaluate market dynamics rapidly, making it a pivotal software for each novice and skilled merchants alike.

The importance of various candle patterns can’t be overstated. For example, bullish and bearish engulfing patterns are essential indicators of potential reversals out there. A bullish engulfing sample happens when a small crimson candlestick is adopted by a bigger inexperienced candlestick, suggesting that patrons have overtaken sellers, signaling a possible value improve. Conversely, a bearish engulfing sample, characterised by a inexperienced candle adopted by a bigger crimson candle, might point out a forthcoming decline as sellers achieve management.

Moreover, doji candles play a notable function in candlestick evaluation. These candles are fashioned when the opening and shutting costs are practically equal, reflecting market indecision and uncertainty. The looks of a doji typically suggests {that a} development could also be weakening, prompting merchants to reevaluate their positions. Recognizing these patterns empowers merchants to anticipate shifts in market habits, thus enhancing their buying and selling methods.

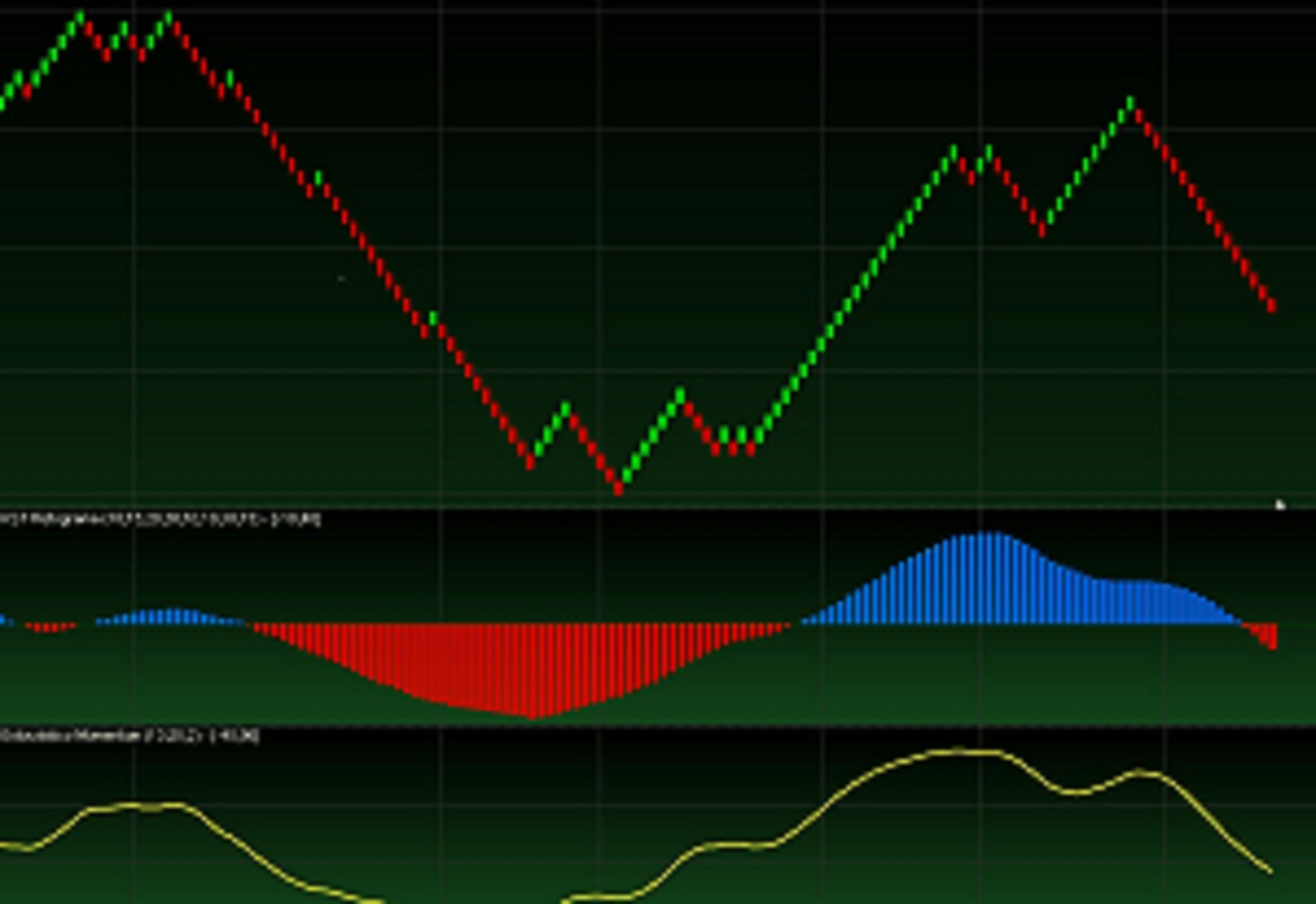

Incorporating candlestick evaluation into buying and selling methods entails inspecting these patterns along with different technical indicators. For instance, utilizing candlesticks alongside shifting averages or momentum indicators can present a complete view of market circumstances. Such a multifaceted method allows merchants to make extra knowledgeable selections primarily based on the interaction between value motion and prevailing indicators.

The Significance of Inventory Buying and selling Alerts

Within the fast-paced world of inventory buying and selling, the flexibility to reply rapidly to market actions is paramount. Inventory buying and selling alerts function important instruments for buyers and merchants, offering real-time notifications that assist them make knowledgeable selections. These alerts can considerably improve the effectivity of buying and selling actions, permitting people to grab worthwhile alternatives and successfully handle dangers. By staying up to date on market adjustments, merchants can react promptly as an alternative of relying solely on guide monitoring.

One of many main sorts of inventory buying and selling alerts is value alerts. These notifications inform merchants when a inventory reaches a specified value level, enabling them to interact in shopping for or promoting at optimum moments. Worth alerts are notably helpful in risky markets the place inventory costs can fluctuate quickly. The power to execute trades as quickly as these alerts are triggered can result in elevated profitability and lowered losses.

One other necessary sort of alert is quantity alerts, which notify merchants of bizarre buying and selling exercise in a selected inventory. A rise in buying and selling quantity can point out a shift in market sentiment, typically main to cost actions. By staying knowledgeable about quantity adjustments, merchants can higher assess the energy of market tendencies and make strategic buying and selling selections primarily based on real-time knowledge.

Moreover, information alerts present merchants with essential data concerning bulletins that would influence inventory efficiency, reminiscent of earnings experiences, mergers and acquisitions, or regulatory adjustments. These alerts be sure that merchants are outfitted with the most recent data and might alter their methods accordingly, minimizing publicity to dangers. General, inventory buying and selling alerts are invaluable for enhancing buying and selling effectivity by empowering merchants with the information they should act decisively within the markets.

Choices Buying and selling Methods Defined

Choices buying and selling entails numerous methods that merchants can deploy relying on their market outlook and threat tolerance. Understanding these methods is essential for maximizing potential rewards whereas managing dangers successfully. In style approaches embody coated calls, straddles, strangles, and spreads, every with distinctive traits and acceptable utilization situations.

A coated name technique consists of holding an extended place in an asset whereas concurrently promoting name choices on the identical asset. This technique is usually employed when a dealer expects a average improve within the asset’s value however seeks to generate extra earnings from the premiums obtained from the bought calls. The first threat concerned is the potential for missed features if the asset value surges considerably past the strike value, capping income.

Straddles and strangles are methods utilized to profit from important value actions, no matter route. A straddle entails buying a name and a put choice on the identical strike value and expiration date, whereas a strangle has totally different strike costs for the decision and put choices. Each methods grow to be helpful in risky market circumstances, because the dealer income if the asset value strikes considerably in both route. Nevertheless, the important thing threat lies within the potential lack of premium if the market stays stagnant.

Spreads are one other strategic choice that entails the simultaneous shopping for and promoting of choices on the identical asset. This may be executed in numerous types, reminiscent of vertical spreads, horizontal spreads, or diagonal spreads. The purpose right here is to restrict threat and probably improve returns. Every sort of unfold is appropriate for particular market circumstances and depends closely on an understanding of the prevailing tendencies and particular person aims. By utilizing spreads, merchants can create outlined threat profiles and obtain goal revenue ranges whereas minimizing publicity.

In the end, deciding on the suitable choices buying and selling technique requires a radical understanding of the present market panorama and one’s funding targets. By aligning methods like coated calls, straddles, strangles, and spreads with market circumstances, merchants can improve their potential for achievement on this complicated venue.

Diving Into Cryptocurrency Day Buying and selling

Cryptocurrency day buying and selling presents a novel atmosphere characterised by important volatility and fast market actions. Not like conventional markets, the crypto area operates 24/7, providing frequent alternatives for merchants to capitalize on value fluctuations. Nevertheless, this fixed exercise additionally introduces an array of challenges, notably by way of threat administration and market evaluation.

A foundational technique for profitable day buying and selling is the appliance of technical evaluation. This entails evaluating historic value knowledge and figuring out patterns that may recommend future value actions. Merchants typically depend on numerous indicators, reminiscent of shifting averages, Relative Power Index (RSI), and Fibonacci retracement ranges. These instruments allow merchants to make knowledgeable selections primarily based on present market tendencies, which is important within the fast-paced cryptocurrency panorama.

Understanding market tendencies is equally necessary as they’ll considerably affect the efficiency of crypto belongings. Merchants ought to monitor information occasions, regulatory adjustments, and technological developments inside the blockchain sector that would result in important value shifts. Moreover, the sentiment of the cryptocurrency group can play a pivotal function; fashionable opinion can drive fast demand, main to cost surges or drops.

Threat administration ways are essential for sustaining income in day buying and selling. This contains setting stop-loss orders to restrict potential losses and using a diversified portfolio to unfold threat throughout a number of belongings. Merchants should additionally decide their threat tolerance ranges and cling to them strictly, guaranteeing emotional selections don’t undermine their technique.

Moreover, deciding on the suitable buying and selling platform is essential. Quite a few exchanges supply various options, safety measures, and price constructions. Day merchants ought to search platforms that present real-time knowledge analytics, user-friendly interfaces, and robust buyer assist to boost their buying and selling expertise.

Staying Knowledgeable: Foreign exchange Information Impacts

Within the risky world of forex buying and selling, being knowledgeable about foreign exchange information is essential for making sound buying and selling selections. Main financial indicators, central financial institution actions, and important world occasions can have profound results on forex costs. For example, experiences on unemployment charges, gross home product (GDP), and shopper value index (CPI) are pivotal financial indicators that merchants carefully monitor. These indicators present insights into a rustic’s financial well being, which in flip can drive forex valuations. An sudden rise or fall in these numbers can result in heightened volatility in forex pairs, impacting merchants’ positions considerably.

Central banks play a foundational function within the foreign exchange market by their financial coverage selections. Adjustments in rates of interest, for instance, can enormously affect forex demand. When a central financial institution raises rates of interest, it usually attracts international funding, resulting in forex appreciation. Conversely, a charge minimize might end in forex depreciation. Thus, merchants should stay vigilant concerning central financial institution bulletins and coverage shifts, which regularly include steering about future financial instructions.

Furthermore, world occasions reminiscent of geopolitical tensions, pure disasters, or important commerce offers may also sway forex values. The foreign exchange market reacts rapidly to information, that means that last-minute occasions could cause swift market adjustments, which may both profit or hurt a dealer’s place. Because of this, counting on well timed, respected information sources is important for merchants trying to navigate the complexities of the foreign exchange market efficiently. Being well-informed permits merchants to refine their methods in response to rising market circumstances, in the end resulting in extra strategic buying and selling selections.

Navigating Commodity Buying and selling

Commodity buying and selling entails the shopping for and promoting of uncooked supplies, also known as commodities, which might be categorized into two principal sorts: laborious and tender commodities. Exhausting commodities embody pure assets which might be mined or extracted, reminiscent of gold, oil, and metals. However, tender commodities are agricultural merchandise or livestock, together with espresso, corn, and cotton. Understanding the distinctions between these classes is important for merchants trying to develop efficient methods inside this market.

The markets for commodity buying and selling might be fairly dynamic, influenced by quite a lot of elements reminiscent of provide and demand, geopolitical tensions, climate circumstances, and adjustments in authorities coverage. Subsequently, being conscious of the underlying financial indicators that drive commodity costs is essential. For example, a drought can considerably influence tender commodities like wheat, inflicting a spike in costs, whereas elevated industrial demand might increase the costs of laborious commodities like copper.

In relation to buying and selling methods, efficient methods can vary from basic evaluation—inspecting financial indicators and information that have an effect on the commodity’s provide and demand—to technical evaluation, which entails analyzing value charts and using indicators to foretell future value actions. Merchants typically implement stop-loss orders and take-profit orders as a part of their threat administration strategies, serving to to reduce potential losses whereas securing income.

To remain up to date on market tendencies and indicators, merchants ought to depend on a mixture of stories sources, financial experiences, and buying and selling platforms that present real-time knowledge and evaluation. Implementing instruments reminiscent of charts and value comparability programs may also facilitate higher decision-making in commodity buying and selling. By comprehensively understanding the market dynamics, merchants can place themselves to navigate the complexities of commodity buying and selling efficiently.

Understanding Volatility Buying and selling

Volatility buying and selling is a method employed by merchants who intention to capitalize on the fluctuations in asset costs somewhat than the costs themselves. The first goal is to establish and leverage durations of excessive volatility for potential revenue. One of many key metrics used to gauge market volatility is the Volatility Index (VIX), which measures the market’s expectation of future volatility primarily based on choices costs. The VIX usually rises throughout instances of market turmoil, indicating heightened uncertainty amongst buyers. Merchants typically watch this index carefully, as rising VIX values can sign elevated alternatives for volatility-based methods.

Choices buying and selling is without doubt one of the commonest strategies utilized in volatility buying and selling. Merchants might buy or promote choices with the anticipation that volatility will improve, permitting them to profit from adjustments within the pricing of those choices. Choices methods reminiscent of straddles and strangles are notably fashionable. A straddle entails shopping for each name and put choices with the identical strike value and expiration date, designed to revenue from important value actions in both route. Conversely, a strangle entails shopping for name and put choices at totally different strike costs, usually permitting for cheaper entry factors whereas nonetheless taking advantage of volatility.

Market sentiment shifts can considerably affect volatility and current each alternatives and dangers. A bullish sentiment usually results in decreased volatility, whereas a bearish sentiment typically ends in elevated market fluctuations. Understanding these shifts is important for volatility merchants, as they point out when to enter or exit trades successfully. Nevertheless, volatility buying and selling shouldn’t be with out its dangers; sudden market actions can result in substantial losses. To handle these dangers, merchants ought to implement threat administration methods reminiscent of stop-loss orders and place sizing, guaranteeing they’re ready for hostile market circumstances. By way of cautious evaluation and strategic planning, merchants can navigate the complexities of volatility buying and selling efficiently.

Integrating Varied Buying and selling Methods

Profitable buying and selling typically requires a multifaceted method, whereby merchants can enormously profit from integrating totally different buying and selling methods. By combining strategies from candlestick evaluation, choices buying and selling, and volatility buying and selling, one can create a well-rounded technique that addresses numerous market circumstances and reduces general threat. This diversified method permits merchants to capitalize on alternatives that come up in numerous market environments, whereas additionally offering a security web throughout unsure instances.

Candlestick evaluation serves as a necessary software on this built-in technique. It presents visible insights into market sentiment by patterns that signify potential value actions. For example, observing a bullish engulfing sample would possibly immediate a dealer to enter an extended place, whereas a doji may point out a market reversal, urging warning. By recognizing these patterns, merchants could make knowledgeable selections which might be basic to profitable buying and selling.

Choices buying and selling provides one other layer of complexity and flexibility to a dealer’s toolkit. By utilizing choices, merchants can hedge towards market fluctuations or leverage their positions with much less capital outlay in comparison with conventional inventory buying and selling. Methods reminiscent of coated calls or protecting places can be utilized in tandem with different strategies, permitting merchants to handle threat extra successfully and improve returns on their present portfolios.

Volatility buying and selling additional enhances these methods, because it focuses on capitalizing on value fluctuations. Merchants can make the most of devices like volatility indices or choices to benefit from altering market volatility. By monitoring indicators that sign shifts in volatility, merchants can alter their methods accordingly, guaranteeing they continue to be agile and ready for market adjustments.

In the end, integrating numerous buying and selling methods fosters a extra resilient method to buying and selling. It’s essential for merchants to stay vigilant and adaptable, adjusting their strategies primarily based on the prevailing market circumstances to maximise their potential for revenue whereas minimizing threat publicity.

Conclusion: Crafting a Personalised Buying and selling Plan

As we’ve got explored all through this information, the huge world of buying and selling is characterised by its complexities and fast fluctuations. A customized buying and selling plan shouldn’t be merely a suggestion; it’s a vital part for anybody looking for to navigate the market successfully. By integrating insights from numerous methods, together with candlestick evaluation, inventory alerts, and choices methods, merchants can tailor an method that aligns with their particular person aims and market circumstances.

One of many first steps in drafting your personal buying and selling plan is to evaluate your threat tolerance. Understanding how a lot you might be prepared to lose will considerably affect your buying and selling selections. Increased threat might supply the potential for greater returns, however it additionally will increase the chance of considerable losses. Subsequently, a essential a part of profitable buying and selling is establishing parameters that really feel comfy, thereby permitting you to make knowledgeable selections with out succumbing to anxiousness or impulse buying and selling.

Subsequent, contemplate your funding targets. Are you on the lookout for short-term features, or are you in it for the lengthy haul? Every technique calls for a unique method; short-term merchants typically depend on market tendencies and fast analyses, whereas long-term buyers would possibly concentrate on basic evaluation and broader market indicators. Moreover, your understanding of market dynamics performs a significant function in crafting your buying and selling technique. The extra acquainted you grow to be with market circumstances, the higher outfitted you’ll be to make educated trades.

In the end, the journey of buying and selling is continuous studying and adaptation. It is very important stay curious and open to new applied sciences, instruments, and academic assets. Over time, as you refine your buying and selling plan primarily based in your experiences and evolving market insights, you will see that your self extra assured and succesful in your buying and selling endeavors. Implementing these methods is not going to solely enable you to navigate market actions but in addition empower you to grab alternatives as they come up.